Our experienced engineers & quality equipment are always on call, ready to support you.

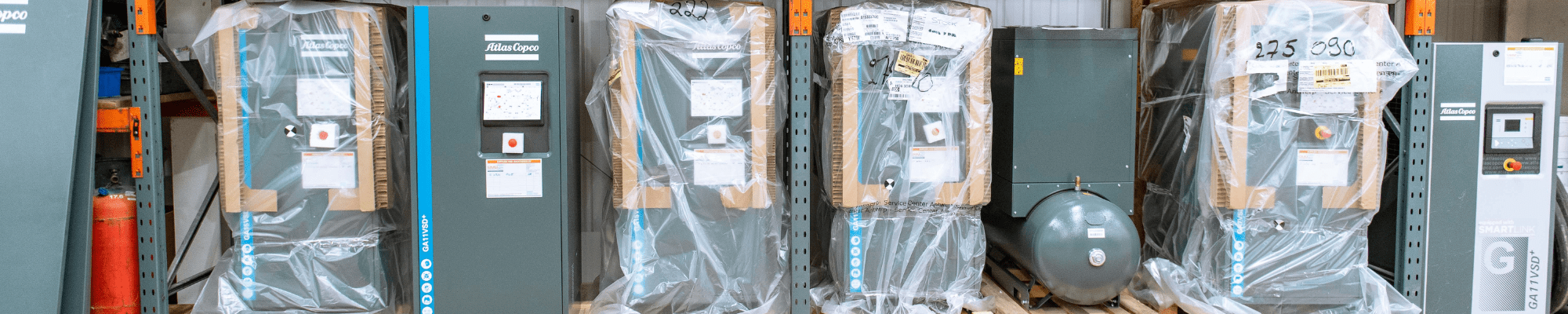

We offer fast and efficient hire and leasing of air compressors (stationary and portable options), vacuum pumps, nitrogen generators, dryers and other machinery, to keep your production schedule on target.

Whether you need a stationary air compressor hire or are looking for a portable air compressor hire solution, we have you covered. Our stationary air compressor hire fleet covers 2-160kW range and our portable air compressors are available with a variety of power sources including diesel, electric and battery.

Our diverse fleet of air dryers can match the scale of your production and cater to short-term and long-term requirements. Our air dryers are suitable for a variety of applications, including construction, manufacturing, pharmaceuticals, and more.

Choose from a comprehensive selection of air receivers that are built to the highest industry standards, ensuring durability and reliability. The range of air receivers comes in various sizes, allowing you to tailor your choice based on the demands of your compressed air system.

Whether you need a vacuum pump for a day, a week or an extended period, our flexible hire solutions can cater to your needs. Our team can assist you in specifying the optimal vacuum pump for your production.

Emergency Hire – For today, tomorrow or forever

Crisis cover for equipment that has broken down or following a fire, flood or other disaster.

Contingency Planning – Prepare in advance, minimise downtime

Plan ahead to use our hire fleet for additional capacity during a busy period/increased workload.

Research and Development – When you need to test the waters

A low risk way to try before you buy to test a machine with a new product line or process.

Planned Shutdown – Short term support for long term gains

Cover when you are moving premises or during a factory renovation

We can also remove old equipment for you and either repair or dispose of it as required.

For short and long-term solutions, we can offer a site visit to assess your specific needs, followed by a quotation and a fast and efficient installation of your hire equipment.

If you have won some new business but are unsure whether it will be over the short or long term, a hire machine can help you handle the increase in production until you have a clearer picture of your future capacity requirements.

If you are considering purchasing a new air compressor, a hire machine will allow you to test the capacity and operation with your existing system. This can be particularly useful with the latest Atlas Copco variable speed drive (VSD, VSD+ and VSDs) machines, which provide a high air flow for much less energy than older fixed-speed models.

Hire machines can also provide useful on-site back-up if your current machine is ageing and you have been experiencing frequent breakdowns.

If you are moving premises or refitting or expanding your current factory, a hire machine can keep production running while you move your air compressor or commission new equipment. Alternatively, you can use a hire machine to test newly installed production lines before moving your existing compressor to a new site.

You can trust in our experienced professional team to provide you with expert advice and a bespoke solution, with the right hire equipment for your needs.

Emergency hire is all in a day’s work for us. We can provide a quick fix to help you out of a tight spot – and then advise on longer term solutions to suit your needs and budget.

After a site visit from our engineers, we will supply you with a quote, followed by the smooth, efficient installation of your hire equipment.

Our large range of hire equipment is stored at our Sheffield branch, just off the M1. From here our team can quickly despatch hire equipment to any part of the UK and to suit any industry.

Chat to our team about hire solutions »